nc estimated tax payment calculator

The act went into full effect in 2014 but before then North Carolina had a three-bracket progressive income tax system with rates ranging from 6 to 775. The average effective property tax rate in North Carolina is 077 well under the national average of 107.

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Income Tax

Want to schedule all four payments.

. It can also be used to help fill steps 3 and 4 of a W-4 form. Switch to North Carolina salary calculator. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes.

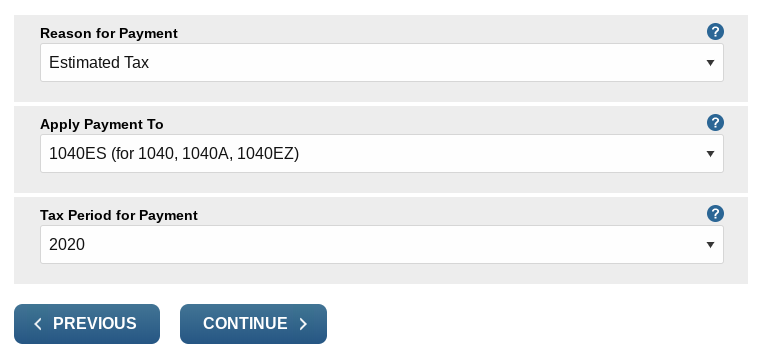

To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Enter Your Status Income Deductions and Credits and Estimate Your Total. Once youve used our estimated tax calculator to figure out how much you owe making the payment is fairly straightforward and takes less than 15 minutes.

Use the Create Form button located below to generate the printable form. Get a clear breakdown of your potential mortgage payments with. This calculator is intended for use by US.

Overview of North Carolina Taxes. I am filing as a non-resident. North Carolina Income Tax Calculator 2021.

How To Calculate Payroll Taxes Methods Examples More Created with Highcharts 607. Country if not US Payment Amount whole dollar amounts 00. North Carolinas property tax rates are relatively low in comparison to those of other states.

Income tax you expect to owe for the year. File Pay Taxes Forms Taxes Forms. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

PO Box 25000 Raleigh NC 27640-0640. Experian 2020 Q1 data published on August 16 2020 Across the industry on average automotive dealers make more money selling loans at inflated rates than they make from selling cars. North Carolina Gas Tax.

Individual Income Tax Sales and Use Tax Withholding Tax. There is a variation on lottery tax on winnings according to country policy for. Please enter the following information to view an estimated property tax.

April 15th payment 1 June 15th payment 2 September 15th payment 3. Nc estimated tax payment calculator. North Carolina Department of Revenue.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. To pay individual estimated income tax. This North Carolina hourly paycheck calculator is perfect for those who are paid on an hourly basis.

North Carolinas statewide gas tax is 3610 cents per gallon for both regular and diesel. Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules. Do not print this page.

Use eFile to schedule payments for the entire year. Schedule payments up to 60 days in advance. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498.

The tax rate cuts will disproportionately help the richest earners. After a few seconds you will be provided with a full breakdown of the tax you are paying. 7 Mail the completed estimated income tax form NC-40 with your.

Your county vehicle property tax due may be higher or lower depending on other factors. Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate data to the user. Individual estimated income tax.

Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax. Before you sign a loan agreement with a dealership you should contact a community credit union or bank and see how they compare. Calculate net income after taxes.

Beginning July 1 2022 the applicable rate is 2 percent 2 for each month or part of a month that the payment is late up to a maximum penalty rate of 10 percent 10. What is individual estimated income tax. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Home File Pay Taxes Forms Taxes Forms. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Make one payment or.

This calculator is designed to estimate the county vehicle property tax for your vehicle. For details visit wwwncdorgov and search for online file and pay For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and. Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download.

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return. I live in VA and work in NC In performing my tax review the software flagged my estimated tax payments bc I checked 1a and 3a on the estimated tax worksheet. Import tax data online in no time with our easy to use simple tax software.

But a different change that lawmakers have also passed to increase the standard deduction. North Carolina repealed its estate tax in 2013. Contact your county tax.

Pay individual estimated income tax. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. PO Box 25000 Raleigh NC 27640-0640.

The calculator should not be used to determine your actual tax bill. Income Tax Calculator Estimate Your Refund In Seconds For Free. North Carolina Department of Revenue.

2022 NC-40 Individual Estimated Income Tax. PO Box 25000 Raleigh NC 27640-0640. Ad Filing your taxes just became easier.

This is my first year filing a NC State return. The personal income tax rate will drop from the current 525 to 499 next year and will continue to decline gradually over the next few years until reaching 399 in 2026 and -of the. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major.

Individual Income Tax Sales and Use Tax Withholding Tax. Youll need to make the payments four times per year according to these due dates. The estimated tax you will pay.

In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate applies. Calculate net income after taxes. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

File Pay Taxes Forms Taxes Forms. Nc estimated tax payment calculator. From January 1 2022 through June 30 2022 the applicable rate is 10 percent 10 regardless of how late the tax is paid.

This mortgage calculator will help you estimate the costs of your mortgage loan. File your taxes stress-free online with TaxAct. You can also pay your estimated tax online.

The tax rate cuts will disproportionately help the richest earners. Find your total tax as a percentage of your taxable income. On an amended return the late payment penalty.

North Carolina Estate Tax.

Florida Seller Closing Costs Net Proceeds Calculator Closing Costs How To Memorize Things Printable Worksheets

Pin On Real Estate Is My Passion

North Carolina Income Tax Calculator Smartasset

Petty Cash Book 7 Per Page Cash Petty Books

How To Create An Invoice In 2022 Cloud Based Training Video Development

Real Estate Blog Keeping Current Matters Real Estate Buyers Real Estate Trends Real Estate Education

Pin On Us Tax Forms And Templates

Discover Hidden North Carolina Attractions Find Unusual Things To Do In North Caroli North Carolina Cabins North Carolina Vacations North Carolina Attractions

Buying A Home Do You Know The Lingo Infographic Home Buying Home Buying Process Sell Your House Fast

North Carolina Income Tax Calculator Smartasset

15 Self Employment Tax Deductions In 2022 Nerdwallet Capital Gains Tax Income Tax Brackets Income Tax Return

Mortgage Calculator Mortage Calculator Mortgage Comparison Mortgage Payoff

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

Quarterly Tax Calculator Calculate Estimated Taxes

It S Tax Season Use Your Refund To Jump Start Your Down Payment Savings Tax Season Tax Refund Tax Time

Quarterly Tax Calculator Calculate Estimated Taxes

Almost Every Home We Are Seeing On The Market Is Receiving Multiple Offers Look At These Stats Thinking Of Selling Y National Association Offer Marketing

Make An Estimated Tax Payment Youtube

Infographic What S The Difference Between Mortgage Pre Approval And Pre Qualification Mortgage Tips Mortgage Loan Originator Wealth Management